Nearly a decade after the introduction of the Model Mortgage and Foreclosure Law (MMFL), many Nigerian states have yet to adopt its provisions, creating significant roadblocks for mortgage-backed homeownership and investment in the housing sector.

Despite its potential to transform the mortgage landscape, only a handful of states Lagos, Ekiti, Nasarawa, and Kaduna have enacted their versions of the law. This reluctance by most state governments has discouraged property developers and mortgage investors from engaging in these regions, stalling progress in addressing Nigeria’s growing housing deficit.

The MMFL was designed to establish state-level mortgage boards that simplify property registration, streamline title perfection processes, and enable non-judicial foreclosure mechanisms. The law aims to create a conducive environment for mortgage origination, allowing citizens to access affordable housing while generating jobs and boosting internally generated revenue. However, approximately 32 states have yet to domesticate the law, leaving Nigeria’s housing sector fragmented and underfunded. In states like Edo, Akwa Ibom, and Cross River, the law remains in various stages of legislative limbo, while Ogun State is merely awaiting the governor’s sign-off.

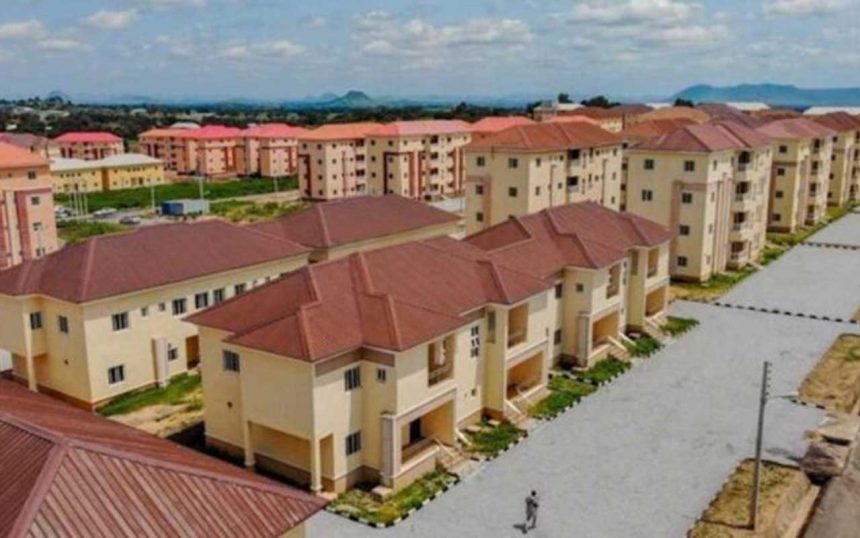

In contrast, states that have embraced the MMFL are seeing tangible benefits. Lagos, for example, has implemented a rent-to-own scheme backed by its mortgage board, enabling over 20,000 residents to purchase homes with a low-interest rate of 6% and a repayment period of up to 10 years. Similarly, Nasarawa State’s passage of the law has made real estate investments more secure and bankable, attracting investors and improving homeownership rates.

The persistent housing deficit in Nigeria remains staggering. A World Bank survey revealed that 700,000 housing units are needed annually to meet demand, yet only about 100,000 units are produced yearly. This shortfall has resulted in an accumulated deficit, further exacerbated by a lack of mortgage financing. According to a 2020 Central Bank of Nigeria (CBN) report, the country requires between N15 trillion and N20 trillion in mortgage financing to bridge the housing gap, but only 5% of Nigeria’s 13.7 million housing units are currently financed through mortgages.

The mortgage sector’s challenges are compounded by an underwhelming contribution to the nation’s GDP—just 0.5%. This figure pales in comparison to countries like Namibia, where mortgage penetration accounts for 18.9% of GDP, and South Africa at 16.2%. In Nigeria, reliance on personal savings rather than mortgages continues to dominate the housing market. This is largely due to the absence of an effective foreclosure mechanism, which deters lenders from offering mortgages. Obtaining a foreclosure order through the courts can take years, discouraging financial institutions from taking on the risk of non-repayment.

The MMFL introduces several innovative features to address these challenges, including the establishment of mortgage registries, streamlined consent requirements, and alternative dispute resolution mechanisms. Notably, it allows for non-judicial foreclosure, enabling lenders to reclaim properties without prolonged court proceedings. For instance, Kaduna State’s 2017 adoption of the MMFL has made it easier for lenders to recover defaulted loans, creating a more favorable environment for mortgage investments.

However, the adoption of the MMFL has faced resistance from state governments, primarily due to the provisions of the Land Use Act, which vests land ownership in state governors. Many governors are hesitant to be bound by foreclosure laws, fearing a loss of control over land matters. This reluctance has stalled efforts to create a unified mortgage framework across the country.

Experts argue that widespread adoption of the MMFL is crucial for unlocking Nigeria’s housing potential. Former President of the Mortgage Banking Association of Nigeria (MBAN), Adeniyi Akinlusi, emphasized that effective foreclosure laws would enable more citizens to own homes, thereby addressing economic disempowerment and attracting investment into the housing sector. Similarly, the Chief Executive Officer of the Nigerian Mortgage Refinance Company (NMRC), Kehinde Ogundimu, noted that the MMFL provides a sound legal framework for mortgage transactions, making real estate investments more secure and expanding revenue streams for state governments.

Despite these benefits, public perception remains a challenge. Many Nigerians view foreclosure as a draconian measure, fueling fears of losing their homes. To address this, the term “foreclosure” is being rebranded as “Mortgage Loan Administration” to make the concept less intimidating. Advocates stress that the law is not about forcefully taking over properties but about creating opportunities for more Nigerians to access homeownership through a sustainable mortgage system.

The stakes are high. Without widespread adoption of the MMFL, Nigeria’s housing deficit will continue to grow, leaving millions without access to affordable homes. States that delay passing the law risk missing out on the economic and social benefits of a thriving housing sector. For Nigeria to close its housing gap and foster economic growth, state governments must prioritize the domestication of the MMFL, creating an environment where affordable homeownership becomes a reality for all.