UK house prices increased by 0.8% in July, and lower mortgage rates are expected to lead to continued growth throughout the rest of the year, according to mortgage lender Halifax.

The average house price in the UK for July was £291,268, marking a 0.8% rise from the £289,042 recorded in June. This significant uptick follows three subdued months, with rises of only 0.1% to 0.2%. The annual growth rate also rose to 2.3%, the highest since January this year.

Amanda Bryden, head of mortgages at Halifax, highlighted that last week’s Bank of England base rate cut and the recent reduction in mortgage rates from major providers are encouraging signs for those hoping to buy new homes or move up the housing ladder.

Bryden added, “Against the backdrop of lower mortgage rates and potential further base rate reductions, we anticipate house prices to continue a modest upward trend throughout the remainder of this year.”

Related Posts:

- Bank of England Rate Cut Spurs Surge in UK Property Market

- UK Housing Market Shows Signs of Recovery Amid…

- Nigeria's Inflation Spikes to 33.88% in October,…

- 30-Year Fixed US Mortgage Rates Hit 7.04%, Highest…

- Nigeria’s Inflation Rises to 34.6% in November as…

- The UK property outlook for 2025: another bleak year…

READ ALSO: UK Housing Market Shows Signs of Recovery Amid Potential Interest Rate Cuts

Last week, the Bank reduced interest rates from 5.25% to 5%, the first cut in four and a half years. However, it cautioned savers not to expect more large cuts in the coming months as it aims to ensure inflation does not return to the high levels seen over the last two years.

Several major banks have been cutting their mortgage rates recently. Last week, lenders such as Halifax, NatWest, and Santander reduced interest rates by up to 0.20 percentage points. Nationwide, the UK’s biggest lender, has also started offering a sub-4% deal for some new buyers.

Sam Mitchell, CEO of Purplebricks, remarked, “The growing confidence we’ve seen take hold of the housing market in recent weeks has been supercharged by the BoE’s interest rate cut. With lenders already slashing mortgage rates in response to last week’s decision, buyers are beginning to move ahead with purchasing decisions they have been putting off for months.”

Despite these reductions, mortgage rates remain much higher than those before and just after the coronavirus pandemic. Bryden warned that affordability constraints and the lack of available properties continue to pose challenges for prospective homeowners.

READ ALSO: UK Housing Offers the Worst Value Compared to Other Countries

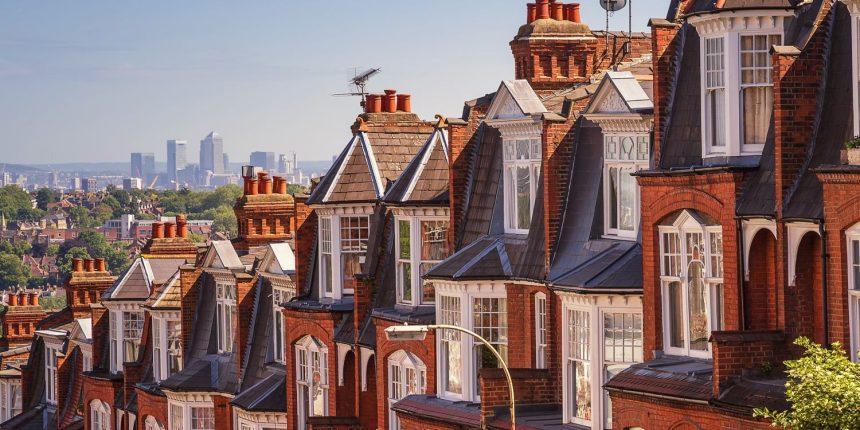

London remains the most expensive area, with the average property costing £536,052, up 1.2% from last year’s figure. Northern Ireland experienced the biggest rise in prices, with the average home cost rising 5.8% to £195,681 in July. The second biggest increase was in the north-west of England, where prices rose by 4.1% to £232,489.

Amy Reynolds, head of sales at the estate agency Antony Roberts in Richmond, London, observed, “With an unexpectedly busy start to August in our offices, the long-awaited cut in interest rates and removal of any election uncertainty has clearly gone down very well with prospective buyers and sellers. However, buyers need to be careful what they wish for as cheaper mortgages will almost certainly mean higher asking prices. If we see a flurry of new applicants encouraged by cheaper mortgage rates, then these higher prices are likely to be achieved.”

Separate research by the Royal Institution of Chartered Surveyors (Rics) found that expectations for a house sales uptick over the next few months have reached their strongest levels since shortly after the Covid pandemic was declared. A net balance of 30% of property professionals expect sales to rise over the next three months, the most positive sentiment seen since January 202