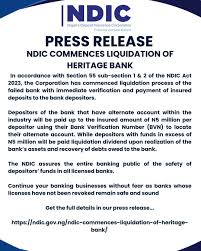

The Nigerian Deposit Insurance Commission (NDIC) has initiated the liquidation process of Heritage Bank, following the revocation of its license by the Central Bank of Nigeria (CBN).

The NDIC, appointed as the liquidator, has assured depositors of the bank of verification and payment processes.

According to a statement by the Acting Director of Corporate Communication at the CBN, Sidi Ali, the decision to liquidate Heritage Bank was due to its breach of Section 12 (1) of BOFIA, 2020, and its inability to improve financial performance, posing a threat to financial stability.

READ ALSO: CBN Revokes Heritage Bank’s Operating License

The NDIC, in its statement signed by Bashir Nuhu, the Director of Communication & Public Affairs, announced that depositors could receive up to N5 million. Those with alternate accounts within the industry will be paid up to the insured amount of N5 million per depositor using their Bank Verification Number (BVN). Depositors with funds exceeding N5 million will receive liquidation dividends after the realization of the bank’s assets and debt recovery.

Depositors without alternate bank accounts are advised to visit the nearest branch of the bank with proof of account ownership and identification for verification and subsequent payment of insured sums. The NDIC also urged the bank’s creditors to file their claims at the nearest branch or online.

READ ALSO: CBN Revokes Heritage Bank’s Operating License

The Bank Customers Association of Nigeria has expressed support for the CBN’s decision, emphasizing the importance of safeguarding the banking sector’s stability. The House of Representatives has also pledged to engage with stakeholders to ensure the protection of depositors’ funds and the stability of the financial system.

The House Committees on Banking Regulations and Insurance will oversee the liquidation process to ensure transparency and accountability, with a focus on protecting depositors’ rights and maintaining confidence in the financial sector.