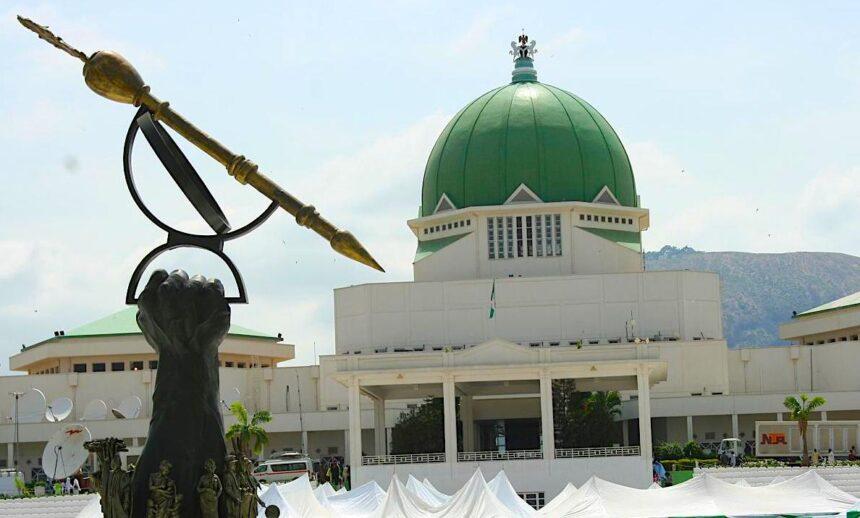

Image source: Premium Times

National Housing Fund: Banks, insurers’ keeps owing… as HDAN threaten to sue CBN

The National Housing Fund (NHF) is owed trillions of Naira in unremitted funds by deposit money banks and insurance firms operating in the nation for failing to invest in the NHF as required by law under NHF Act No. 3 of 1992.

The Federal Mortgage Bank of Nigeria (FMBN), the managers of the Fund, are intended to receive at-source deductions from the banks and transfer them to the Central Bank of Nigeria (CBN), however, the CBN has fallen short of this duty.

Investigations revealed that the nation’s banks and insurance companies should have made investments in the Fund in accordance with the Act’s requirements.

The NHF plan was created to make it easier for low-cost funds to flow continuously for long-term housing investments for the benefit of fund donors. According to the NHF Act, the fund’s resources must come from both public and private contributions from Nigerians, investments by commercial and merchant banks, contributions from insurance companies that are licensed to do business under the Insurance Act, and financial contributions from the federal government for long-term loans.

Investigations also turned up the fact that since the housing fund’s existence, neither deposit money banks nor insurance firms have contributed a single kobo. Officials of these financial institutions claimed ignorance of the existence of such provisions when faced with the terms of the Act regarding their expected payments.

Section 5 of the NHF Act stipulates: “Every commercial or merchant bank shall invest in the fund 10 per cent of its loan and advances at an interest rate of 1 per cent above the interest payable on current account by banks. Every registered insurance company shall invest a minimum of 20 percent of its non-life funds and 40 per cent of its life fund in real property development of which not less than 50 per cent shall be paid into the fund through FMBN at an interest rate not exceeding 4 per cent. Nothing contained in the insurance act or relating to the investment of insurance companies in real property shall affect the provision of this Act (1991 no 58.).”

Officials of banks, who spoke differently on condition of anonymity, said they were not aware of the provisions in the Act that mandated banks to contribute to the NHF. They were however quick to add that their banks have been contributing to housing development through their various mortgage products.

Even the CBN is culpable in this infraction, because it is the duty of the apex bank, under the Act, to collect contributions from banks and remit the same to FMBN.

Section 11 of the Act states: “Central Bank of Nigeria (CBN) shall collect from commercial and merchant banks at the end of every year and not later than month thereafter, the percentage of their contribution to the fund as specified in section 5 (1) of this Act. CBN shall within two months of making collection under subsection (1) of this Act pay the money to the bank for investment in the fund.”

However, the CBN has not been complying with this provision.

The Federal Mortgage Bank of Nigeria (FMBN) was empowered by the NHF Act to manage and administer the Fund to ensure that proceeds are utilized to finance the housing sector of the economy through wholesale mortgage lending to primary mortgage institutions (PMIs)

Given that banks are supposed to invest 10 per cent of their Loans and Advances into the National Housing Fund, about N10.494 trillion should have been invested in the Fund by the banks.

Housingreporters also got other stakeholders to bear their minds on this development which has far-reaching implications on housing finance in Nigeria. Dr. Aliyu Wamakko, President of the Real Estate Developers Association of Nigeria (REDAN), the umbrella body of property developers in the country, said the general attitude of banks toward housing finance in the country is lamentable.

“It is a serious matter, which bothers on violation of the constitution. What we intend to do is to liaise with HDAN, the National Assembly and other stakeholders on necessary action.

We will take steps to sensitize the National Assembly on the development and also write to the CBN because this shows clearly that the apex bank has not been playing its expected role as a regulator of the banks.

Wamakko added that a lot of advocacy is also required on the part of the mass media to bring out some of these facts into the public domain in order to ensure that everybody plays a role in financing housing development in the country.

In a reaction by one of the operators who said his name should not be mentioned, “I’m not very sure of this provision. I’m only aware of similar regulations under the SMEs where banks are specifically required to yield up 10 percent of their PAT to the CBN. Most banks chose to set up institutional vehicles to run this scheme. But the question is how successful has it been up to date.

In a swift reaction to the refusal of CEOs of insurance companies to respond to the invitation of the House of Reps committee investigating NHF contributions, the Executive director of the Housing Development Advocacy Network HDAN, Festus Adebayo said the advocacy group may result in legal action against CBN for its failure to implement the NHF act because this is a total violation of the Constitution of the Federal Republic of Nigeria

“We have raised alarm on this last year when the office of Accountant General was illegally deducting 40% of NHF fund in FMBN remittal account. We are happy to hear that have stopped but we will consult with Labour Unions on the next line of action.