The African real estate landscape in 2025 presents a dynamic mix of growth, innovation, and challenges.

While the continent faces hurdles such as housing deficits and regulatory complexities, it also boasts significant opportunities for investors and developers.

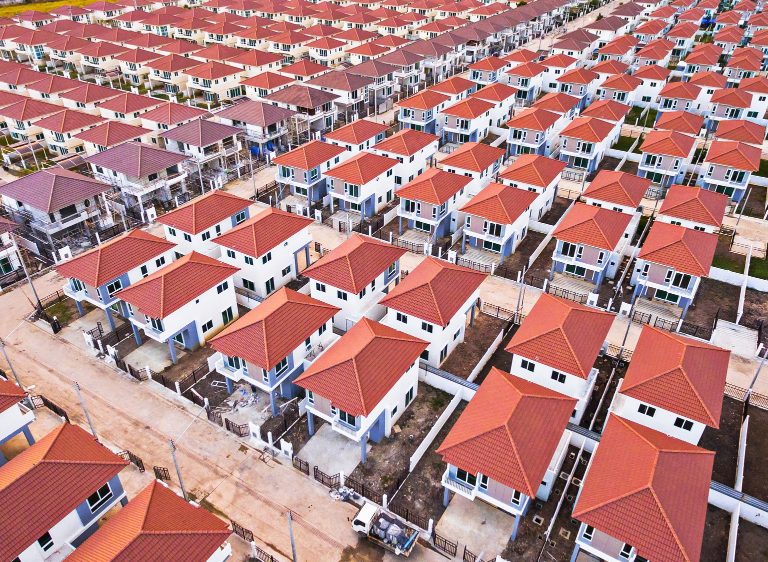

The sector, fueled, by rapid urbanization, a burgeoning population, and growing foreign investment, the continent is witnessing a surge in construction and development. From bustling metropolises like Lagos and Johannesburg to emerging markets in East Africa, the demand for housing, commercial spaces, and infrastructure is steadily increasing. However, this growth is not without its hurdles. Issues such as inadequate infrastructure, regulatory complexities, and housing shortages persist, requiring innovative solutions and collaborative efforts to unlock the full potential of this vital sector

Key Growth Drivers:

• Urbanization and Population Growth: Rapid urbanization across Africa is fueling demand for housing, commercial spaces, and infrastructure. The burgeoning population, particularly in younger demographics, is driving increased demand for housing and related services.

• Economic Expansion: Continued economic growth in many African countries, though facing global headwinds, is creating a more robust middle class with increased disposable income. This translates to higher demand for quality housing and commercial spaces.

• Foreign Direct Investment (FDI): Growing interest from international investors is injecting capital into the African real estate market. Factors like favourable exchange rates in some countries and the allure of emerging markets are attracting foreign capital.

• Technological Advancements: The integration of technology is revolutionizing the sector. PropTech solutions are streamlining property management, improving market efficiency, and enhancing customer experiences.

Market Highlights:

• Ghana: A stable political environment and steady economic growth make Ghana a prime investment destination. Accra and Kumasi are witnessing significant development, with a focus on modern, mixed-use developments.

• South Africa: While facing economic challenges, South Africa offers a relatively mature real estate market with opportunities in both residential and commercial sectors. The rise of AI and PropTech is enhancing market efficiency and attracting tech-savvy investors.

• Kenya: Nairobi remains a key hub for real estate investment, though challenges related to overvaluation and regulatory issues persist.

• Nigeria: Despite challenges like bureaucratic hurdles, Nigeria presents a large and dynamic market with high potential returns, particularly in the commercial and industrial sectors.

Key Trends:

• Sustainability: A growing emphasis on sustainability is driving the development of green buildings and eco-friendly communities. This includes the incorporation of renewable energy sources, water conservation measures, and sustainable construction materials.

• Technology Integration: The adoption of PropTech solutions is accelerating, encompassing areas such as property management software, online platforms for property search and transactions, and the use of AI for predictive analytics and risk assessment.

• Co-living and Shared Spaces: The rise of co-living spaces and flexible workspaces is catering to the evolving needs of younger generations and the growing gig economy.

• Regeneration of Urban Areas: Many African cities are undergoing urban renewal projects, revitalizing older neighbourhoods and creating vibrant mixed-use developments.

Challenges:

• Housing Shortages: Severe housing deficits persist across many African countries, particularly in rapidly growing urban centres. This necessitates a concerted effort to develop affordable housing solutions.

• Infrastructure Gaps: Inadequate infrastructure, such as limited access to reliable electricity and transportation, poses a significant challenge to real estate development.

• Regulatory Hurdles: Sometimes, inconsistent regulations can hinder investment and slow development projects.

• Corruption and Lack of Transparency: Corruption and lack of transparency in some markets can deter investors and create an uneven playing field.

The Road Ahead:

The African real estate sector is poised for significant growth in the coming years, driven by urbanization, economic expansion, and technological advancements. However, addressing housing shortages, infrastructure gaps, and regulatory hurdles will be crucial for sustainable and inclusive growth.