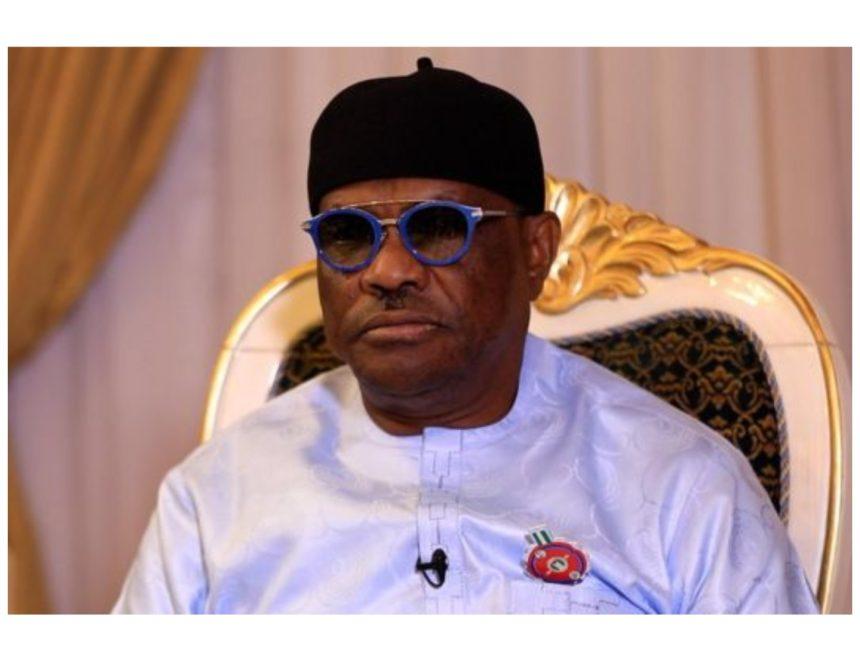

The Federal Capital Territory Minister, Nyesom Wike, has issued a stern caution to employers in the nation’s capital concerning taxation obligations.

In a statement disclosed by Mustapha Sumaila, Head of Corporate Communications at the Federal Capital Territory Internal Revenue Service (FCT-IRS), Wike emphasized the necessity for all employers in Abuja to submit their 2023 annual returns by January 31, 2024.

Sumaila highlighted that this directive aligns with Section 41 of the Personal Income Tax Act (PITA) 2011 (as amended). Moreover, he underscored the statutory provisions outlined in Sections 94, 95, and 96 of PITA, which specify penalties for non-compliance, incorrect declarations, and late submissions.

“The Service will not hesitate to enforce these laws against defaulters,” Sumaila asserted.

Furthermore, FCT-IRS urged employers, organizations, and agents to adhere to the January 31 deadline for filing their returns. Sumaila cautioned that late submissions and non-compliance would incur penalties in accordance with the law.

READ ALSO: FCT Minister Calls for Unity in Building a Stronger Capital Territory

The directive aims to ensure timely and accurate tax filings from employers within the Federal Capital Territory, underlining the importance of compliance with tax regulations.

Source: Dailypost