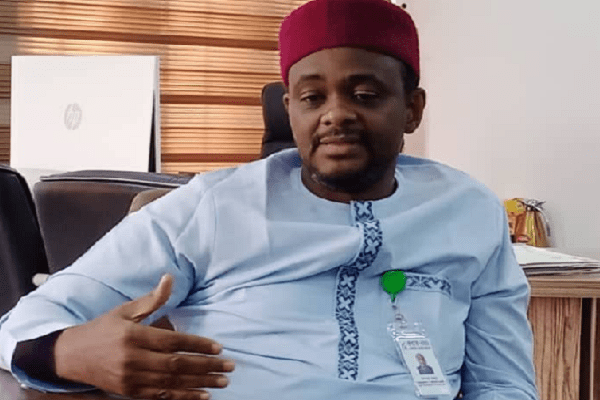

The Executive Chairman of the Federal Capital Territory Internal Revenue Service, Haruna Abdullahi, He highlighted the mandate requiring Tax Clearance Certificates (TCC) for residents to obtain building permits and conduct business with the FCT Administration, activated through sections 85 of the Personal Income Tax Act and 31 of the FCT-IRS Act endorsed by FCT Minister Nyesom Wike.

Addressing operational challenges, Abdullahi emphasized the significance of political support in overcoming obstacles associated with revenue collection. He stressed the need for clarity, facing hurdles from stakeholders due to misunderstanding and lack of information.

READ ALSO: FCT introduces Tax clearance certificate for all services

Abdullahi outlined measures undertaken to bolster FCT revenue, including the approval of initiatives by the FCT Minister and the proposal for FCT Property Tax regulation. These strategies, including the implementation of Capital Gains Tax and activation of tax sections, aim to substantially impact revenue generation.

READ ALSO: Wike Constitutes Taskforce On Mass Housing C-o-O, Landuse Contravention

The TCC requirement for building permits was underscored, emphasizing the necessity for taxpayers to file returns and possess a verifiable TCC to obtain such permits. He clarified the verification process and emphasized its importance in curbing fraudulent practices.

Highlighting mechanisms for tax enforcement, Abdullahi emphasized the need to provide reasons for compliance. He referenced the importance of Section 85 compliance for vehicle registration and efforts to digitalize systems to enhance tax accountability.

READ ALSO: Despite economic crisis, Wike proposes N15bn for VP’s new residence

Abdullahi discussed the evolution of FCT-IRS, citing increased revenue from N40 billion to N145 billion, attributing the growth to regulatory efforts and institutional capacity building.

Regarding citizen expectations upon tax compliance, Abdullahi stressed the government’s obligation to utilize generated revenues for societal benefits, acknowledging the visible impact of tax revenues on developmental projects.

In summary, Abdullahi emphasized the need for civic responsibility and accountability, urging citizens to contribute to revenue generation and hold the government accountable for resource utilization.

Source: Thisday