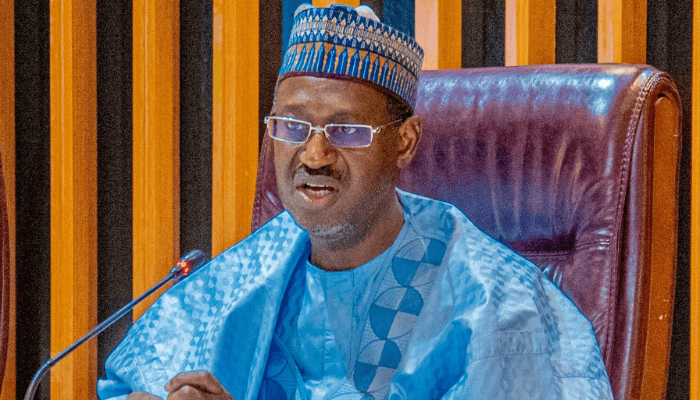

In a detailed review of the housing sector’s performance in 2024, Festus Adebayo, the Executive Director of Housing Development Advocacy Network (HDAN), shed light on the achievements, setbacks, and hopes for the future.

Speaking during an exclusive interview on the Inside the Real Estate program on Housing TV Africa, Adebayo offered an in-depth analysis of the sector’s trajectory over the past year.

Reflecting on the year’s start, he noted that the housing sector began on a high note, contributing a remarkable ₦11.5 trillion to Nigeria’s GDP in the first quarter, according to the Nigerian Bureau of Statistics. By the second quarter, the sector had maintained its strong contribution, with over ₦11 trillion added to the GDP, showcasing the resilience of stakeholders across diverse sectors, including building materials, real estate, and manufacturing.

However, Adebayo highlighted that as the year progressed, economic instability significantly impacted the industry. “Inflation was high, interest rates soared to double digits, and the cost of transportation and building materials skyrocketed,” he explained, noting that cement prices alone reached unprecedented levels of ₦9,500 per bag. These factors rendered affordable housing delivery a daunting task, forcing developers to focus on luxury homes and pushing many prospective buyers into the rental market.

The affordability crisis was exacerbated by challenges in accessing low-interest mortgage financing. Adebayo lamented the single obligor problem in fmbn where the cbn gave the rules that prevented some Primary mortgage banks from accessing National Housing Funds in Federal Mortgage Bank.This no doubt,according to Adebayo constrained mortgage banks from creating mortgages apart from the problem of high interest rates being faced by then.

These restrictions left many developers and prospective homeowners without the financial support needed to create mortgages.

Despite these hurdles, Adebayo commended the Federal Mortgage Bank of Nigeria (FMBN) for expanding its focus, including issuing a ₦100 billion Bankable Offtakers Guarantee to a consortium of developers under President Bola Ahmed Tinubu’s Renewed Hope Housing Programme. He also acknowledged the Federal Housing Authority (FHA) for acquiring land and securing Certificates of Occupancy (C-of-O) across numerous states.Significant activities were witnessed in lagos but we await to see what we happen to those lands of fha in states in 2025.

Key achievements in the sector in 2024 included the establishment of a national housing data system by the Minister of Housing and Urban Development, a milestone in development for two years. This comprehensive database, supported by the Nigerian Mortgage Refinance Company (NMRC), the Central Bank of Nigeria, and the National Bureau of Statistics, is expected to enhance transparency and planning in the housing sector.

In legal reforms, Adebayo underscored the collaboration between the World Bank and the Federal Ministry of Housing on land reform. He emphasized that land reform is critical not only for real estate but for businesses across Nigeria. With expectations high, the Honorable Minister is anticipated to take definitive action on this issue in 2025.

The Ministry of Finance Incorporated Real Estate Investment Fund (MREIF) also marked progress, with its potential to impact both the demand and supply sides of the housing sector. Additionally, Nigerian Mortgage Refinance Company (NMRC) secured a $200 million affordable housing fund from the U.S. International Development Finance Corporation (DFC) at a minimal interest rate, complemented by $28 million sourced from local financial markets. Adebayo noted that this investment would provide much-needed liquidity to the mortgage finance market and support the sector’s growth.

The international dimension of 2024 was underscored by the visit of a UK delegation during the Africa International Housing Show. The delegation engaged with key Nigerian leaders and hosted a dinner at the UK Ambassador’s Residence, showcasing international collaboration as a bright spot in a challenging year.

Looking ahead, Adebayo expressed optimism for 2025. He emphasized that with President Tinubu’s commitment to improving the economy and reforms in the Federal Mortgage Bank, the sector is poised for a better performance. The anticipated contributions from MREIF and ongoing efforts in land reform are expected to address critical challenges and pave the way for affordable housing solutions.