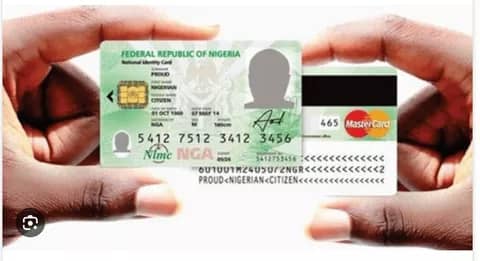

In a strategic move aimed at revolutionizing social and financial services, the Federal Government of Nigeria has joined forces with the National Identity Management Commission (NIMC), the Central Bank of Nigeria (CBN), and the Nigeria Inter-bank Settlement System (NIBSS) to introduce an innovative identity solution integrated with payment functionality.

Known as AfriGO, this domestic card scheme will power a new era of convenience and accessibility for Nigerians.

According to a statement from the Head of Corporate Communications of NIMC, Kayode Adegoke, the newly launched National ID card will incorporate verifiable identity features mandated by the NIMC Act No. 23 of 2007.

READ ALSO: CBN’s Recapitalization May Lead to Closure, Acquisition of 11 Banks

This multifaceted card is designed to fulfill a range of needs, from proving identity to accessing government and private services, promoting financial inclusion, and fostering citizen empowerment.

To ensure eligibility for the card, individuals must be registered citizens or legal residents possessing the National Identification Number (NIN).

Built to meet international standards, the card will serve as the country’s default national identity card while also functioning as a debit or prepaid card, offering users flexibility in managing their finances.

READ ALSO: Minister of Works Disappointed with Progress on Akure-Ikere-Ado Road Construction

Moreover, the card will facilitate access to various government intervention programs, addressing the needs of financially underserved populations. Stringent measures will be in place to safeguard cardholders’ personal data, aligning with data protection regulations and international standards on data security protocols.

Key features of the card include a Machine-readable Zone (MRZ) compliant with International Civil Aviation Organization (ICAO) standards, biometric authentication capabilities, and offline transaction capabilities for areas with limited network coverage. Additionally, the card will include essential information such as travel, health insurance, microloans, and subsidies for sectors like agriculture, transportation, and energy.

READ ALSO: Bankers Criticize Central Bank’s Capital Guidelines Over Retained Earnings Exclusion

Requests for the card can be made online, at commercial banks, participating agencies or agents, and NIMC offices nationwide, catering to both banked and unbanked individuals.

This initiative marks a significant step forward in leveraging technology to enhance identity management and financial inclusion across Nigeria.