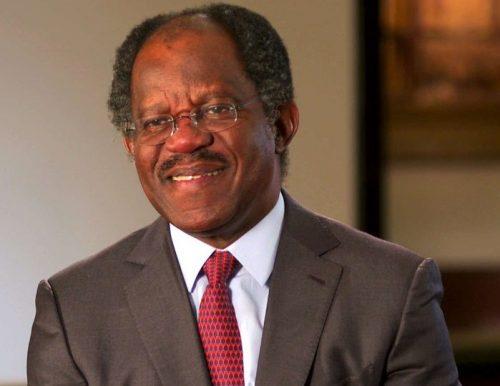

BlackRock, the biggest asset management company in the world, has said it is buying Global Infrastructure Partners, a company founded by Nigerian investment banker Adebayo Ogunlesi, in a $12.5bn deal.

According to a statement released on Friday, Blackrock is to pay $3bn in cash and offer Ogunlesi and five other co-founders of Global Infrastructure Partners 12 million shares in Blackrock, thus making them the second biggest shareholders in the global asset management giant.

BlackRock said it would also appoint Ogunlesi, GIP Founding Partner, chairman and CEO, to the board at the next scheduled board meeting after the close of the deal.

“The combination of GIP with BlackRock’s highly complementary infrastructure offerings creates a comprehensive global infrastructure franchise with differentiated origination and asset management capabilities,” the statement said.

BlackRock said GIP’s acquisition aligns with the vision of Laurence Fink, its chairman and Chief Executive Officer, to transform the firm into a key player in the growing market for private and alternative assets.

READ ALSO: Lagos State Government Seeks Collaboration for Lekki-Epe Road Construction Improvement

It added, “The over $150 billion combined business will seek to deliver clients market-leading, holistic infrastructure expertise across equity, debt and solutions at substantial scale.

“Marrying the proprietary origination and business improvement capabilities of GIP and BlackRock’s global corporate and sovereign relationships provides a platform for diversified, large-scale sourcing to support deal flow and co-investment opportunities for clients. We believe bringing GIP and BlackRock together will deliver to clients the benefits of broader origination and business improvement capabilities.”

Commenting on the acquisition, Fink said the deal is “one of the most exciting long-term investment opportunities.”

Global Infrastructure Partners has $106bn invested in infrastructure, while Blackrock manages $10tn worth of alternative assets.

Ogunlesi, an alumnus of King’s College Lagos and Harvard University, was chief client officer and vice chairman at Credit Suisse First Boston before leaving to start Global Infrastructure Partners.

His profile grew in Nigeria after Global Infrastructure Partners bought Gatwick Airport. The main assets of GIP, of which Ogunlesi is chairman, include Sydney, the Port of Melbourne, the Suez Water group, extensive green energy holdings, and a stake in a big shale oil pipeline.

Investment in infrastructure is considered an “alternative asset” class for traditional money managers like BlackRock.

The deal makes Blackrock the second-biggest private investor and manager of infrastructure in the world.

source: Punch Newspaper