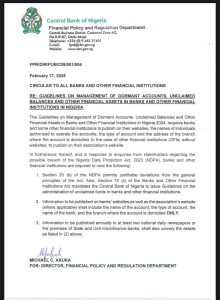

The Central Bank of Nigeria (CBN) has directed banks to publish dormant accounts, unclaimed balances, and financial assets online.

Banks must display account holders’ names, account types, and branch locations on their official websites for public access.

Institutions without websites should publish these details on their association’s platform to ensure compliance with the directive.

The directive aligns with Section 25(b) of the Nigeria Data Protection Act, 2023, which allows justifiable deviations.

Section 72(ii) of the Banks and Other Financial Institutions Act also mandates proper handling of unclaimed financial assets.

CBN further instructed annual publication of this information in at least two national newspapers for transparency purposes.

A dormant account refers to a bank account that remains inactive without any transaction for at least one year.

This move follows CBN’s recent order requiring banks to meet insider lending limits within 180 days for stability.