The Nigerian naira has been on an impressive upward trajectory, unsettling the foreign exchange (FX) market and sparking a wave of concern among dollar holders.

This unexpected appreciation has sent ripples through the parallel market, leaving many traders scrambling to adjust to the rapidly shifting dynamics.

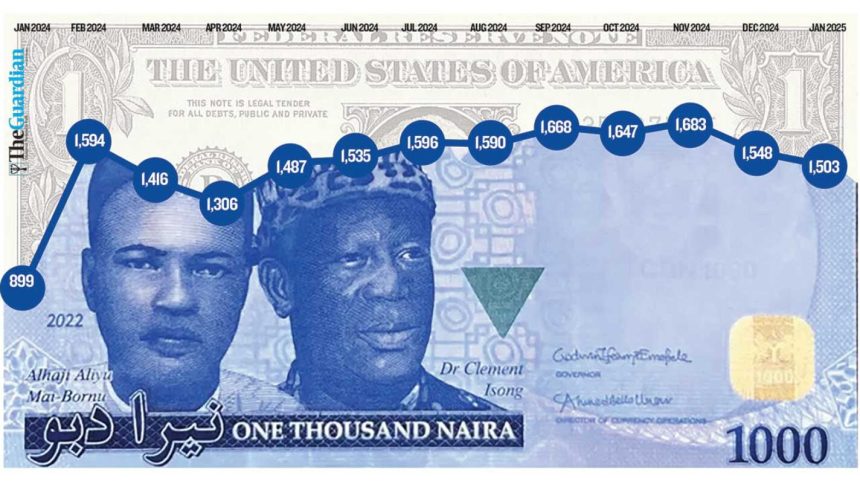

At the start of the year, the naira’s bullish momentum caught FX traders off guard. Having hovered between ₦1600/$ and ₦1800/$ for the better part of eight months, the local currency defied expectations, surging past the ₦1600/$ mark to close at approximately ₦1560/$ last weekend. This marked the first time in months that the naira has breached this psychological barrier, signaling a potential shift in Nigeria’s currency landscape.

The ripple effect has been particularly harsh on black market traders, with estimated losses ranging between ₦10 billion and ₦20 billion. Many traders, who had stockpiled dollars anticipating a seasonal surge in demand from returning Nigerians in January, found themselves on the losing end as the naira continued its rally. The typical January spike in demand failed to materialize, turning what was once a reliable profit period into a financial quagmire.

In the official FX window, the naira also showed strength, dipping below ₦1500/$ for the first time in recent history. Data from FMDQ indicated an average trading rate of ₦1,476.74/$, highlighting the currency’s resilience across both official and parallel markets. This development has fueled debates among economists and market analysts about the sustainability of the naira’s newfound strength.

While some experts dismiss the naira’s surge as a temporary blip—a classic “dead cat bounce”—others argue it reflects a genuine market correction. Comercio Partners, in its 2025 Macroeconomic Outlook, projected the naira could depreciate to ₦1800/$ by year-end, a stark contrast to its current performance. Conversely, Bismarck Rewane of Financial Derivatives Company posited that the naira is trading below its fair value, estimating its true market worth at around ₦1107/$ based on purchasing power parity.

Underlying the naira’s rebound are several macroeconomic factors. The Central Bank of Nigeria’s (CBN) commitment to maintaining high-interest rates has bolstered investor confidence, attracting foreign portfolio investments. Projections suggest the CBN might hold off on interest rate cuts until late in the year, providing further support to the naira. Additionally, Nigeria’s bond yields, nearing 20 percent, offer attractive real returns, especially if inflation trends downward.

Domestic shifts are also at play. A noticeable decline in FX balances held by commercial and investment banks suggests a pivot towards naira-denominated assets. Investors, seeking better returns, are liquidating dollar holdings to capitalize on local opportunities, including bank equities amid ongoing recapitalization efforts. For instance, Fidelity Bank’s recent public offer was oversubscribed by 238 percent, raising ₦23.77 billion.

International dynamics further complicate the picture. The U.S. dollar, while currently strong, faces structural vulnerabilities due to mounting foreign liabilities and shifting global economic alliances. The rise of BRICS, now encompassing over 50 percent of the global population and nearly 40 percent of global GDP, challenges the dollar’s dominance. Nigeria’s inclusion as a partner member could subtly bolster the naira’s standing in the long run.

Yet, challenges remain. The CBN’s delayed implementation of Bureau de Change (BDC) reforms raises questions about regulatory resolve. The proposed consolidation, aimed at curbing anti-market practices, could enhance market stability if executed effectively.

In the grand scheme, the naira’s recent gains represent more than a fleeting market anomaly. They reflect a complex interplay of local reforms, investor behavior, and shifting global economic tides. Whether this resurgence will endure or fade under external pressures remains to be seen, but for now, the naira is enjoying a rare moment in the financial spotlight.