The Central Bank of Nigeria (CBN) has raised its Monetary Policy Rate (MPR) by 50 basis points, bringing the benchmark interest rate to 27.25 percent.

This marks the fifth consecutive hike in 2024, as the apex bank continues efforts to manage inflationary pressures.

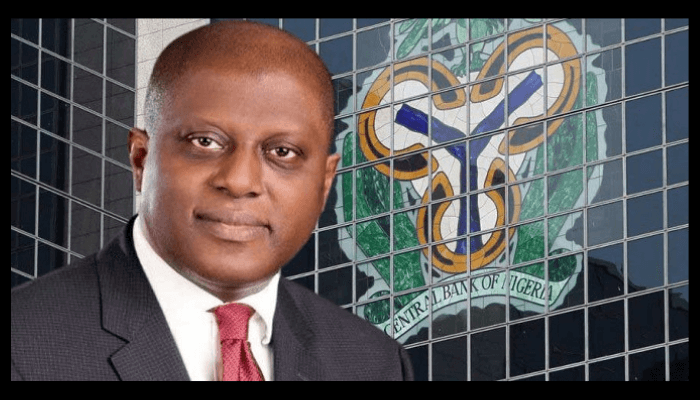

During a two-day Monetary Policy Committee (MPC) meeting in Abuja, CBN Governor Olayemi Cardoso announced the decision, which was supported unanimously by all 11 committee members. According to Cardoso, the hike aims to reinforce the bank’s efforts to curb inflation, despite recent signs of moderation in inflation rates.

READ ALSO: CBN Appoints New Board of Directors for Keystone Bank

In addition to the MPR adjustment, the CBN also increased the Cash Reserve Ratio (CRR) for commercial banks by 500 basis points, raising it to 50 percent from 45 percent. Merchant banks faced a smaller increase, with their CRR rising by 200 basis points to 16 percent, up from 14 percent.

Related Posts:

- Breaking: CBN raises benchmark MPR by 200 basis…

- African Central Banks Respond to Inflation with…

- CBN Faces Criticism After Fifth Interest Rate Hike in 2024

- Private Sector Foresees Inflation and Job Cuts Due…

- Nigeria’s Inflation Rises to 34.6% in November as…

- CBN to Banks, Expedite Action on Recapitalization

The CBN maintained the asymmetric corridor around the MPR at +500/-100 basis points, while the liquidity ratio was left unchanged at 30 percent.

READ ALSO: CBN Explains Reasons Behind Revocation of Heritage Bank’s License

While many analysts had predicted a halt in rate hikes due to easing inflation, the CBN opted for further tightening to ensure inflation remains under control in the coming months.